What happens after appointment?

What must the Personal Representative do after being appointed?

The three primary responsibilities of a personal representative are:

- Marshal assets, and file an Inventory and Appraisal of the estate assets,

- pay debts, taxes and liabilities of the estate, and

- distribute the remaining assets to the persons entitled to receive them.

How do I “Marshal Assets”?

After appointment, the personal representative must marshal, or take possession, of all of the decedent’s property to be administered as part of the probate estate.

Obtaining a Tax I.D. number:

Before an estate checking account can be established or existing accounts can be transferred, the personal representative will need to obtain from the Internal Revenue Service a “Tax Identification Number” for himself or herself as Personal Representative of the decedent’s estate.

This is done by completing an Application for Employer Identification Number ( IRS Form SS-4 ). Call the IRS at (559) 452-4010 to obtain a number. The SS-4 form must be faxed to the IRS at (559) 443-6961 within 24 hours after the tax identification number is assigned. You can also apply for this number on the Internal Revenue Service website at www.irs.gov .

Notice of Fiduciary Relationship:

The personal representative must also notify the Internal Revenue Service of his or her appointment by filing a Notice of Fiduciary Relationship (IRS Form 56 ).

Intangible Personal property (cash and investments) :

Once a tax identification number has been obtained, cash accounts standing in the decedent’s name may be closed and transferred to an estate account in the personal representative’s name. If closing the decedent’s account would trigger early withdrawal penalties, the registration of the account may be changed to the name of personal representative without closing the account.

You will need to talk to the officials at the bank to find out their specific requirements.

Stock certificates and brokerage accounts should also be changed to reflect the change in ownership from the decedent to the personal representative so that dividends and earnings can be correctly reported on behalf of the estate.

Real property:

It is not necessary to record a deed to change title to the decedent’s real property. Instead, the personal representative must notify the Tax Assessor in the county or counties where the decedent’s real property is located by filing with the Assessor the following forms:

- Notice of Death of Real Property Owner

- Preliminary Change of Ownership Report

- Claim for Reassessment Exclusion for Transfer Between Parent and Child (this is required if the property will pass from parents to child) or the Claim for Reassessment Exclusion Form for Transfer Between Grandparent and Grandchild (if the property will pass from grandparent to grandchildren) to avoid property tax reassessment

- Copy of decedent’s death certificate.

These and other forms are available through the website of the Office of the Assessor for Santa Clara County.

How do I file the Inventory and Appraisal?

Within four months after appointment, the personal representative must file with the court an inventory of the property to be administered as part of the probate action, together with an appraisal of the fair market value of each item of property as of the decedent’s date of death.

Preparation of Inventory and Appraisal:

You must use the printed form, Inventory and Appraisal (Form DE-160, Judicial Council), and the Inventory and Appraisal Attachment (Form DE-161, Judicial Council).

As personal representative, you should complete and sign the front side of the Inventory and Appraisal form (leaving the line for “Total Appraisal by Referee” blank, but otherwise answering each section), and describe each asset on the Attachment forms.

Each item of property must be described fully so that it can be identified and appraised, including account numbers, legal descriptions, license numbers, etc. The property is divided into two categories: property that can be appraised by the personal representative (Attachment 1), and property that must be appraised by a probate referee (Attachment 2).

In addition, each item should reflect whether the property is the decedent’s separate property or the decedent’s one-half interest as community property of the decedent and his or her surviving spouse.

Property to be listed on Attachment 1:

Money and other “cash” items, including accounts in financial institutions, refund checks (including tax and utility refunds, Medicare, medical insurance and other health care reimbursements), money market funds and cash held in a brokerage cash account, and proceeds of life insurance policies and retirement plans and annuities payable to the decedent’s estate in lump sum amounts.

Each item should list the dollar value as of the decedent’s date of death.

Property to be listed on Attachment 2:

All property not included on Attachment 1, including but not limited to real property; stocks, bonds, mutual funds and other securities; and tangible personal property such as automobiles; partnership and business interests. Household furniture and furnishings may be listed as a collective item rather than listing each item of furniture individually.

You should not list the value of these items, but should include a blank space after each item, which will be appraised and completed by the probate referee.

However, if the decedent owned property which would be considered to be a “unique, artistic, unusual or special item of tangible personal property” (such as antique furniture, collectible automobiles, or a coin collection), you may choose to have the item appraised by an independent expert, and should make a notation on the form indicating the property to be appraised by an independent expert.

Probate referee:

Probate Referees are qualified appraisers who have passed stringent education and testing requirements and are appointed by the California State Controller’s Office to act as probate referees for each county. See List of Probate Referees for Santa Clara County.

At the time of appointment of the personal representative, the Probate Court designates on the Order for Probate the probate referee to be used in that estate. The probate referee’s fees (see the local fee schedule ) are set by law as a commission of 1/10th of one percent of the value of the property appraised by the probate referee, with a minimum fee of $75 (representing property having a value of $75,000) and a maximum fee of $10,000 (representing property having a value of $10,000,000).

The property appraised by the personal representative (listed on Attachment 1), as well as any property appraised by an independent expert, is not included in the computation of the referee’s fees. The personal representative is responsible to deliver the completed and signed Inventory and Appraisal (with Attachments 1 and 2) to the Probate Referee, together with any supporting data to enable the Probate Referee to appraise the property listed in the Inventory and Appraisal (such as profit and loss statements for closely held or privately owned business interests).

The Probate Referee should return the completed Inventory and Appraisal with the asset values within 60 days (unless he or she contacts you because additional information is needed).

Warning: Be careful to describe the property accurately and completely on the Inventory and Appraisal. Some common problems include:

1) promissory notes secured by deeds of trust on real property (failure to fully describe the note and the underlying real property, including the recording information on the deed of trust);

2) failure to specify the decedent’s interest (100%, 50%, 25%, etc.) and whether the property is separate or community property.

Partial, supplemental, and amended inventories:

If you are able to include all of the estate assets on one Inventory and Appraisal form, the Inventory and Appraisal should be marked as “Final” at the top of the form. You may also file a “Partial” Inventory for some of the assets, and file a “Final” Inventory when the last of the assets are inventoried.

If you discover additional property belonging to the decedent after the “Final” Inventory has been filed, you should file a “Supplemental” Inventory. If you discover that any of the items listed on a previous Inventory were incorrect (for example, the account number or legal description was wrong), you should file a “Corrected” Inventory to fix the error.

Failure to correct errors can lead to a delay in getting final approval from the court to close and distribute the assets of the estate!

Paying debts and liabilities of the estate

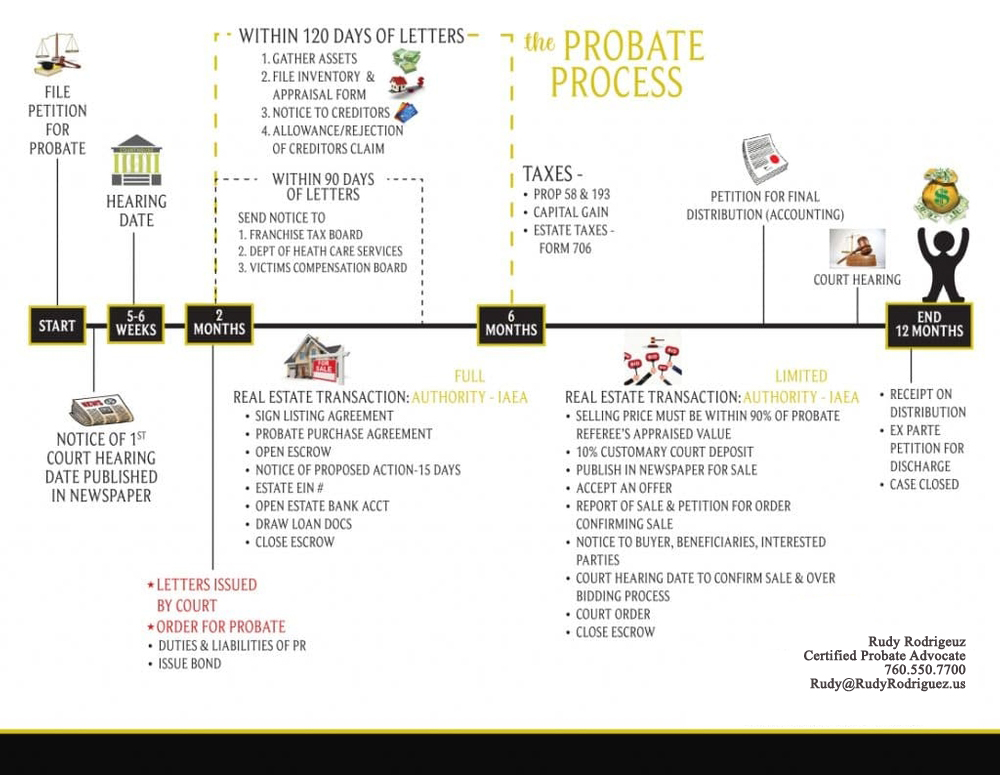

What authority do I have to manage the estate assets?

If the terms of your appointment as personal representative include “authority to administer the estate under the Independent Administration of Estates Act” with “full” or “limited” authority (the power will be included on the Letters or the Order for Probate that were filed when you were first appointed), you have a wide range of powers to conduct certain transactions without court supervision, that is, without having to get court approval first.

However, it may still be necessary to notify the persons who have an interest in the estate before you can perform that action.

What types of actions require a Court hearing?

You must have a hearing and get court approval before you do the following:

- Pay fees or commissions to yourself as personal representative, or to your attorney (if you are represented by an attorney);

- Approve accountings;

- Distribute property (except for distributions that can be made after giving a Notice of Proposed Action;

- Sell or exchange property belonging to the estate to yourself while you are acting as personal representative;

- Enter into a settlement or compromise of any claim involving the estate on behalf of yourself personally or your attorney (if you are represented by an attorney);

- Sell or exchange real property (if you have “limited” authority and not “full” authority). If you must get court approval to sell real property of the decedent, it is strongly recommended that you consult an attorney experienced in probate sales in that the procedures for a court-supervised sale are complicated and require strict adherence to certain procedures and time deadlines, which can jeopardize your sale if not followed correctly.

What types of actions require a Notice of Proposed Action?

After giving a Notice of Proposed Action (Form DE-165) (and if you do not receive any objections), you can do the following:

- Sell or exchange real property (if you have “full” authority);

- Sell or incorporate the decedent’s business;

- Borrow or encumber estate property;

- Grant an option to purchase real property;

- Transfer real property to a person who is given an option to purchase under the decedent’s Will;

- Complete a contract signed by the decedent during his or her lifetime to convey or transfer property;

- Determine claims to property claimed to belong to the decedent or another person;

- Sign a disclaimer on behalf of the decedent;

- Distribute certain types of property after the period for filing creditor’s claims has ended:

- Income received during administration;

- Household furniture, furnishings and tangible personal property (including automobiles) to the persons entitled to receive them under the decedent’s Will, up to a total value of $50,000;

- Cash gifts given under the decedent’s Will, up to $10,000 per person.

What types of actions might require a Notice of Proposed Action under some circumstances?

You generally have the power to take the following actions without prior court authority or giving a Notice of Proposed Action, but you must give a Notice of Proposed Action if you take these actions under the following circumstances:

- Enter into a contract, if the contract cannot be performed within two years;

- Invest money belonging to the estate, if the investment is something other than:

- An obligation of the U.S. or State of California that will mature within one year of making the investment;

- A money market mutual fund with a portfolio limited to U.S. government obligations maturing within five years of making the investment and repurchase agreements fully collateralized by U.S. government obligations;

- Units in a common trust fund invested primarily in short-term fixed income obligations;

- Eligible securities invested in surplus state money;

- Investments that are permitted or directed by the decedent’s Will.

- Continue to operate the decedent’s unincorporated business for a period longer than six months from the date Letters are issued, or if you are acting as general partner of a partnership;

- Pay a family allowance to the decedent’s surviving spouse or minor children, if or when you:

- Make the first payment of a family allowance;

- Making the first payment after 12 months have passed after the decedent’s death; or

- Make any increase in the amount of the payment of a family allowance.

- Lease real or personal property for a term longer than one year:

- Sell or exchange personal property belonging to the estate, if the property is something other than the following:

- A security sold on an established stock or bond exchange;

- A security designed as a national market system security and sold through a registered broker-dealer;

- Perishable or depreciating personal property, or property needed to pay a family allowance

- Grant or extend to a broker an exclusive right to sell property of the estate, if the original grant together with any prior extensions exceed 270 days.

What type of actions do not require prior Court approval or the giving of a Notice of Proposed Action?

As personal representative, you have the power to take the following actions independently, without giving Notice of Proposed Action:

- Approve, pay, reject or contest any claims filed against the estate (except for any claim by or against you); compromise or settle any actions by or against the estate; or release any claims belonging to the estate that you determine are uncollectible;

- Initiate legal actions for the benefit of the estate, or defend actions filed against the estate;

- Extend, renew or modify the terms of an obligation owed to the estate;

- Convey or transfer property if necessary to exercise a specific power given to you as personal representative;

- Pay taxes, assessments, or expenses incurred to collect, care for, or administer the property of the estate;

- Purchase an annuity to satisfy a gift in the decedent’s Will calling for periodic payments to a beneficiary;

- Exercise any option rights belonging to the estate;

- Purchase securities or commodities required to perform an incomplete contract of sale if the decedent died having sold but not delivered securities or commodities not owned by the decedent;

- Hold securities in the name of a nominee or any other form without disclosure of the estate, to allow title to pass by delivery;

- Exercise subscription or conversion rights to securities;

- Make repairs and improvements to real and personal property;

- Accept a deed in lieu of foreclosure on a foreclosure or trustee’s sale; and

- Give a partial satisfaction of a mortgage or cause a partial reconveyance to be signed by a trustee under a deed of trust held by the estate.

How do I give Notice of Proposed Action, if that is required?

Step 1:

Complete the front side and the top half of the reverse side of the following form:

Notice of Proposed Action (Form DE-165, Judicial Council), and all attachments (for example, if you are selling real property, attach a copy of the Residential Property Purchase Agreement or other contract being signed by you, showing the terms of the sale).

Select a date that will allow enough time to give sufficient notice to everyone who is affected by the action. (See Step 2 for time requirements.)

Step 2:

Mail or personally deliver the Notice of Proposed Action form (together with any attachments) to each person at least 15 days before the date specified in the Notice of Proposed Action.

Note: You cannot mail or deliver the papers yourself — ask someone else to do the actual mailing or delivery for you.

The persons who are required to get notice are as follows:

- Each devisee (if the decedent had a Will) whose interest in the estate would be affected by the proposed action;

- Each heir (if the decedent did not have a Will) whose interest in the estate would be affected by the proposed action;

- Each person who has filed a Request for Special Notice; and

- The Attorney General, if any portion of the estate will escheat to the State of California, and its interest would be affected by the proposed action.

You can also (and it is recommended that you do so, if possible) have each of the persons receiving the Notice of Proposed Action date and sign the “Consent to Proposed Action” shown at the bottom of the reverse side of the Notice of Proposed Action form.

You do not have to send Notice of Proposed Action to anyone who signs a Waiver of Notice of Proposed Action (Form DE-166 , Judicial Council). This form can be signed either as to the particular transaction covered by the Notice of Proposed Action, or as a general waiver of all actions requiring Notice of Proposed Action.

Step 3:

Have the person who mailed the Notice of Proposed Action sign a Proof of Service by Mail. If any of the forms were personally delivered, have the person who delivered the Notice of Proposed Action complete and sign a Proof of Service by Personal Delivery (click to see sample form).

File the original Notice of Proposed Action and the Proof of Service by Mail or by Personal Delivery forms with the Probate Filing Clerk.

If anyone has signed the “Consent to Proposed Action” on the reverse side of the Notice of Proposed Action form, or if anyone has signed a “Waiver of Notice of Proposed Action” form, you should also file those.

Step 4:

You must wait until the date specified on the Notice of Proposed Action before you can complete the transaction. (If everyone entitled to notice has signed a Consent or a Waiver to notice, then you do not need to wait until the end of the 15-day period.)

What happens if someone objects to the Proposed Action? I received a Notice of Proposed Action in the mail — how do I object?

Any person entitled to notice of proposed action may object to the proposed action by delivering or mailing a written objection to the personal representative at the address shown in the Notice of Proposed Action. The person may either sign the “Objection” section on the reverse side of the Notice of Proposed Action form, or may file any other writing that reasonably identifies the proposed action and indicates that the person objects.

The objection should be delivered to or received by the personal representative by the later of:

1) the date specified in the Notice of Proposed Action, or

2) the date the proposed action is actually taken.

The person who is objecting may also apply to the court for a restraining order to prohibit the personal representative from taking the proposed action without court supervision.

If someone objects to the proposed action, the personal representative cannot complete the transaction independently, but must seek court supervision or request instructions from the Court concerning the proposed action.

Creditors’ claims

As Personal Representative, what are my responsibilities towards creditors?

As personal representative, you have a duty to notify both known and reasonably ascertainable creditors of the death of the decedent and that you have been appointed as personal representative. This includes not only creditors with outstanding bills such as doctors, credit card companies and utility companies, but also people who may have a potential claim against the decedent on account of something that happened during the decedent’s lifetime.

For example, if the decedent was involved in an auto accident in the year prior to his or her death, or if you learn that someone, even if that person is a relative, may have loaned money to the decedent and may expect to receive payment from the estate, you should notify those persons that probate has begun.

If the decedent may have any liability for taxes incurred before death, whether assessed before or after the decedent’s death (except for real property taxes or assessments), you must give notice to the appropriate tax agency.

In addition, you are also required to notify the Department of Health Services of the decedent’s death if you know or have reason to believe that the decedent received Medi-Cal health benefits or was the surviving spouse of a person who received Medi-Cal health benefits.

It is a good idea to send notice to the Department of Health Services even if you do not have any reason to believe that decedent or his or her surviving spouse received Medi-Cal health benefits.

How do I give Notice to creditors?

Step 1:

Complete the front and reverse side of the following form:

Notice of Administration to Creditors (Form DE-157, Judicial Council). Include on the reverse side the name and address of each creditor or potential creditor who is to get notice.

If you discover additional creditors at a later date, you can send them a copy of the form, but you must use a new form that shows the correct date of mailing.

Note : You cannot mail the forms yourself ask someone else to do the actual mailing for you, and have that person complete and sign the Proof of Service by Mail on the reverse side of the form.

Step 2:

Mail a photocopy of the signed Notice of Administration to Creditors form, together with a copy of a blank Creditor’s Claim form (Form DE-172, Judicial Council). You should mail notice to creditors within the later of:

1) four months after the date Letters are first issued, or

2) 30 days after you first have knowledge of the creditor (even if four months has already passed).

The notice to be mailed to the Department of Health Services should be mailed not later than 90 days after the date Letters are first issued, and should include a copy of the decedent’s death certificate.

Mail the Notice of Administration and the death certificate to the Department of Health Services at the following address:

California Director of Health Care Services

Estate Recovery Section Unit

Mail Stop 4720, P.O. Box 997425,

Sacramento, CA 95899-7425

What do I need to do to locate creditors?

You are not required to make a search for possible creditors. You are required only to notify creditors who are actually known either because information (written or verbal) comes to your attention during administration or the creditor demands payment during administration.

However, you cannot willfully ignore information that reasonably would give you notice that someone may have a potential claim. For example, you cannot refuse to inspect a folder in the decedent’s desk drawer marked “unpaid bills.”

In addition, you do not need to send a Notice of Administration to a creditor who has already filed a formal claim or to a creditor whose bill you intend to treat as a “demand for payment.”

Can I pay the decedent’s debts even if the creditor has not files a claim?

Yes, but only if you are certain both that the bill is valid and that there is enough money in the estate to pay all claims in full, including taxes that may be owed. You may treat a bill as a “demand for payment” even if the creditor has not filed a formal claim.

However, if you have any question as to whether the bill is valid or whether you will be able to pay all of the decedent’s debts in full, you should wait until the end of the claim filing period (the later of four months after Letters were first issued, or sixty days after the last Notice of Administration was mailed) to determine the total amount of creditor’s claims filed against the estate.

Do I need to give Notice to secured creditors?

Secured creditors (such as financial institutions holding a mortgage on the decedent’s home or other real property) should also get notice of the probate administration.

However, a secured creditor does not need to file a formal claim in order to enforce their rights to the secured property, as long as the secured creditor agrees not to pursue any claim against other estate property. You should continue to make mortgage payments if there is sufficient money in the estate to make payments (and pay the other expenses of the estate).

If there is not enough money to continue to make regular payments, you should seek the advice or assistance of an attorney to find out what your alternatives are to avoid foreclosure and protect any equity the decedent or the estate may have in the property.

A creditor has filed a creditor’s claim — what do I do now?

You must review the claim carefully and either allow or reject the claim, in whole or in part, in writing, within 30 days of receiving the claim.

Step 1:

Complete the Allowance or Rejection of Creditor’s Claim form (Form DE-174, Judicial Council). Attach a copy of the Creditor’s Claim filed by the creditor. Only the printed form itself needs to be attached, and not any of the supporting documentation.

Step 2:

Mail a copy of the Allowance or Rejection of Creditor’s Claim form to the creditor. Note: You cannot mail the forms yourself, ask someone else to do the actual mailing for you, and have that person complete and sign the Proof of Service by Mail on the reverse side of the form.

Step 3:

File the original Allowance and Rejection of Creditor’s Claim form with the probate filing clerk

The Decedent owed me money — how do I file a claim against the estate?

Step 1:

Complete the front and reverse side of the following form:

Creditor’s Claim form (Form DE-172, Judicial Council). Itemize the claim and show the date the service was rendered or the debt incurred. Read the form carefully it contains important instructions on filing the claim.

Step 2:

Mail or deliver a copy of the form to the personal representative and his or her attorney. Complete the Proof of Mailing or Personal Delivery on the reverse side of the form.

Step 3:

File the original claim with the probate filing clerk.

You must file the claim with the court before the LATER of (a) four months after the date letters (authority to act for the estate) were first issued to the personal representative, or (b) sixty days after the date the Notice of Administration was sent to you.

Your claim most likely will be invalid if you do not properly complete the form, file it on time with the court, and mail or deliver a copy to the personal representative and his or her attorney.

Step 4:

Wait until you are notified by the personal representative whether your claim has been allowed. You should receive from the personal representative a copy of an Allowance or Rejection of Creditor’s Claim form (Form DE-174, Judicial Council). If the personal representative allows your claim in full, payment should be made prior to the date when the estate is closed and distributed, unless the estate is insolvent and the decedent’s debts must be prorated by the court.

If you want to be informed of proceedings before the court, you can file a Request for Special Notice (Form DE-154 , Judicial Council). If the personal representative rejects part or all of your claim, you must file a separate civil action against the personal representative and the estate within 90 days of receiving the rejection of your claim to establish the validity of your claim.

If you do not receive an Allowance or Rejection of your claim within 30 days after you have filed the claim and mailed a copy to the personal representative, you may, at your option, consider the claim to be rejected and bring an action against the personal representative and the estate.

If you are unable to file your claim within the above deadlines, you may be able to file a late claim if you file a Petition for Leave to File Late Claim with the court showing either of the following:

(1) the personal representative did not send you proper and timely notice of the administration of the estate, and you file your Petition for Leave to File Late Claim within 60 days after you have actual knowledge of the administration of the estate (whether from the personal representative or through some other source of information); or

(2) You had no knowledge of the facts giving rise to your claim against the decedent more than 30 days within the deadlines for filing a creditor’s claim, and you filed your Petition for Leave to File Late Claim within 60 days after you had actual knowledge of the facts giving rise to your claim and the administration of the estate.

No late claims will be allowed under any circumstances if the court has made an order for final distribution of the estate or after one year from the decedent’s date of death.

Does the Probate Judge have to approve creditor’s claims?

If you, as personal representative, have received either full or limited powers under the Independent Administration of Estates Act, then you have the authority to approve or reject creditor’s claims, UNLESS you (or your attorney) are a creditor of the decedent.

If you are the personal representative and you have a claim against the estate, you should complete and file a Creditor’s Claim as to your claim, together with an Allowance and Rejection of Creditor’s Claim.

You should complete and sign the Allowance and Rejection form, but do not complete Item No. 8 (allowance of the claim). File the original Creditor’s Claim and Allowance and Rejection form with the probate filing clerk. The clerk will present your claim to the Probate Judge for approval or rejection.

The judge may require you to file a petition and give notice of hearing before deciding on your claim.

Taxes

Do I need to file tax returns for the estate?

It is likely that you will have to file at least one tax return as personal representative. The taxes to be paid by the personal representative are frequently thought of as only death taxes, i.e., federal estate tax and California estate tax.

However, you also may need to file income tax returns for the decedent and/or the estate. The representative must file all tax returns due and pay all taxes due. As personal representative, you may become personally liable for the payment of taxes if, before the estate is distributed and you are discharged, you had notice of any tax obligations or failed to exercise due diligence as to whether any tax obligations existed.

You may also become liable for any penalties or interest that may assessed on account of late filing, undervaluation, or other deficiencies in the filing of returns.

A common area of misunderstanding lies in fixing the responsibility for filing various tax returns and other documents required for federal and state tax purposes. It is strongly recommended that you retain a professional tax preparer or accountant who is familiar with the tax requirements that apply to a decedent and his or her estate.

However, some general information follows as to the requirements for filing the decedent’s final income tax return, fiduciary income tax returns, and estate tax returns.

Final individual income tax returns:

To determine whether a final income tax return for the decedent is required, you must know the decedent’s gross income, marital status, and age at death.

However, if the decedent had net self-employment income of $400 or more during the taxable year to the date of death, a final federal return must be filed regardless of the amount of gross income. A California income tax return must be filed for every decedent for the year of death, and for prior years, when returns should have been but were not filed by the decedent.

Returns must be filed for estates having gross income in excess of $8000 or net income in excess of $1000. The representative must file the decedent’s final return and any other income tax returns for earlier periods that the decedent was obligated to file at the time of death.

Both the federal and state returns should be marked “FINAL RETURN” and the decedent’s name should appear as the taxpayer on the face of the return, indicating that he or she is now deceased and the date of death.

In addition, the tax year of the return should be filled in, showing a tax year beginning on January 1 and ending on the date of death, and the word “deceased” written across the top of the return. Franchise Tax Board Form 3595, Special Handling Required, should be attached to the face of the California return, with the box indicating that the taxpayer is deceased checked. The return should include the decedent’s social security number or other identification.

The representative or other person filing the return should sign the decedent’s final return on the line indicated for the taxpayer, e.g., “John Doe, Executor, under the Will of Richard Roe, deceased.” If a joint return is filed, the surviving spouse should also sign the return.

The due date for a decedent’s final tax return is the same date as during the decedent’s life.

Fiduciary income tax returns:

For income tax purposes, a decedent’s probate estate is a separate entity that begins at the decedent’s death. A U.S. Fiduciary Income Tax Return (Form 1041) must be filed for an estate with a gross income for the taxable year of $600 or more. A California Fiduciary Income Tax Return (Form 541) must be filed for the taxable period if:

(1) the estate’s gross income exceeds $8000 or

(2) its net income exceeds $1000.

As a practical matter, most tax professionals prepare California fiduciary income tax returns when federal returns are required. If an income tax return is required, the representative may select either a fiscal year, the first year of which ends on the last day of any month no more than 12 months after death, or a calendar year. The estate’s taxable year is considered to begin the day immediately after the date of death.

The estate’s income tax return is due on or before the 15th day of the fourth month after the end of its fiscal year or, if the estate is on a calendar year, on or before April 15th.

Federal and California estate tax returns:

The federal estate tax is an excise tax imposed on all transfers of property from a decedent (whether made during lifetime or at death) and is based on the decedent’s taxable estate, that is, the gross estate less allowable deductions, reduced by allowable credits. A federal estate tax return must be filed on Form 706 for the estate of every U.S. citizen or resident whose gross estate, valued as of the date of death, plus adjusted taxable gifts after 1976 and specific exemption, exceeds the applicable exclusion amount under IRC §2010(c) for the date of death calendar year.

For the years 2011 and 2012, this would mean a gross taxable estate of at least $5,000,000. California does not have an inheritance tax.

Both the federal and California estate tax returns must be filed within nine months after the date of death unless an extension has been received. The extension of time to file is not given automatically, so an application for an extension of time to file should be made to the IRS center where the return is to be filed in adequate time before the return is due, to enable the IRS to consider and reply to the application.

An extension of time to file does not extend the time for payment of the estate tax due, which must be requested separately if needed. Separate penalties may also be assessed for late filing and late payment of the tax due, in addition to interest on the late payments.

The IRS may also impose an “accuracy-related penalty “if it determines that any of the assets are listed on the return are undervalued. It is therefore important to value the assets as accurately as possible. The use of qualified professional appraisers is strongly recommended.